It’s Not Scary If It’s Smart

It started when Chee Leong began to notice his vendors offering more and more services that overlapped with his own company’s. With newer, more innovative competitors entering the market, and with significant changes over the years due to digitalisation, Chee Leong feared that he was in a sunset industry and could soon be made redundant.

“I was reaching my mid-40s and was quite worried that I would become dispensable,” he shares. “If I were to lose my job, I might not be able to find a similar role again.” He also knew that by the time he was made redundant, it would be more difficult for him to find new employment or make a career switch.

Chee Leong had two choices: play it safe, stay put, and risk eventually becoming obsolete, or step forward and take a bold but calculated risk to reskill and enter a new industry.

With great self-awareness and open-mindedness, Chee Leong took charge of his career—instead of waiting for change to happen to him, he made a change instead.

Embracing change and taking ownership

For nine years since 2010, Chee Leong was an IT Systems Engineer in oil and gas. But he had kept his eye on the financial services industry. Specifically, he saw how digital transformation in banking and finance opened up demand for new talents, especially in the areas of cloud computing and cybersecurity.

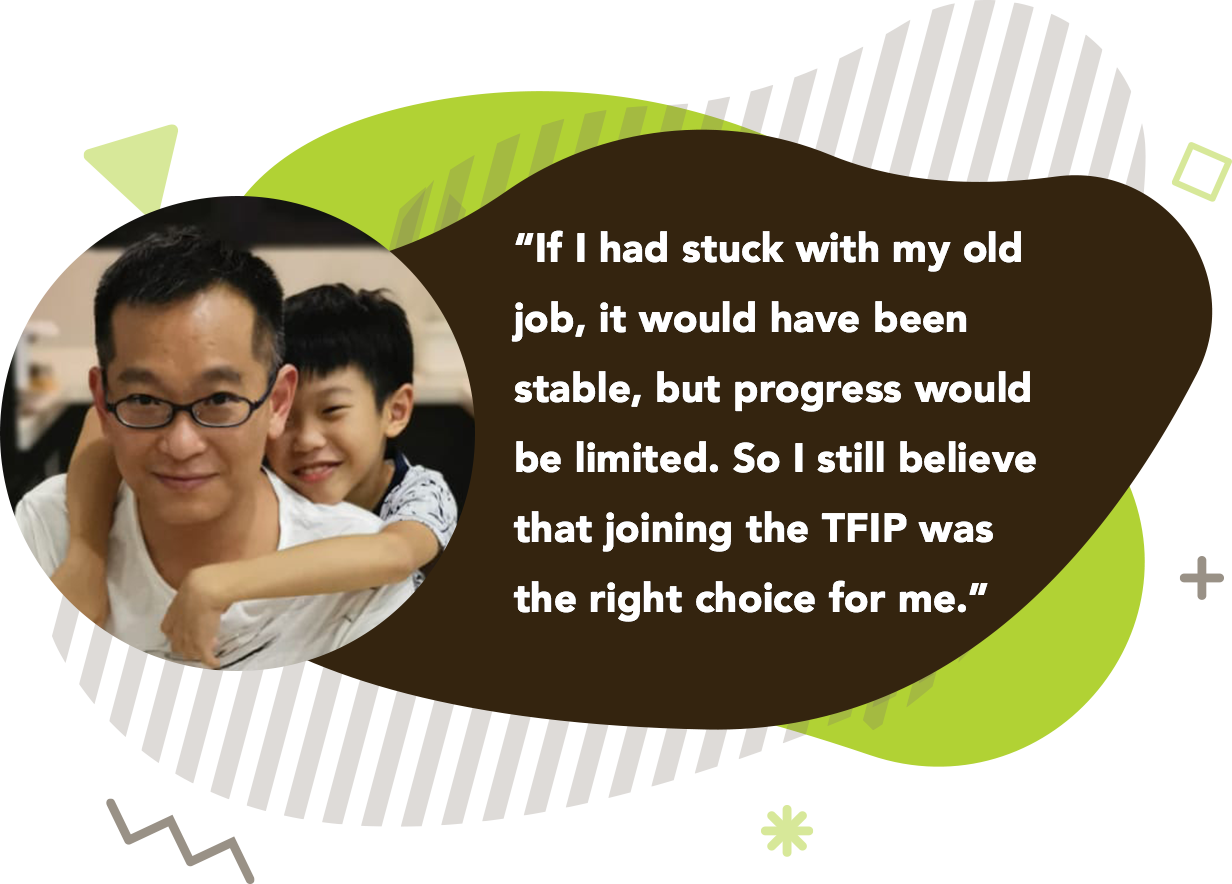

So when an opportunity arose for him to make a mid-career switch, he seized it. With great courage and motivation to succeed, Chee Leong left his job and enrolled in the Technology in Finance Immersion Programme (TFIP).

The TFIP is a joint programme between the Institute of Banking and Finance (IBF), Workforce Singapore (WSG), Infocomm Media Development Authority (IMDA), and Monetary Authority of Singapore (MAS). It’s an intensive 18 or 24-month training programme that prepares inpiduals for a career in new technology areas in the financial services sector, even if they have no prior experience in the industry.

Trainees can choose to specialise in artificial intelligence, cloud computing, cybersecurity, data analytics, or full stack development, and after a period of structured training, will be attached to a financial institution for on-the-job training.

Chee Leong chose the cloud computing track because it best matched his personal interests and professional experience. And while he knew the journey ahead wouldn’t be easy, he was sure that he was on the right path

The greater the challenge, the greater the reward

One of the biggest challenges Chee Leong faced was the sheer speed and intensity of his TFIP training. For two months, he attended full-day courses from 8 a.m. to 6 p.m., Mondays to Friday.

“To be suitable for TFIP, you have to be willing to learn and adapt."

"Even for me, who came from an IT background, there was a significant difference and shift in environment when I moved to the financial services industry, for example, there were regulations and compliance guidelines to be familiarised with,” he reflects. “You also need to be able to pick up new skills within a short period of time and be prepared to accept challenges, learn more and learn fast.”

Luckily, he’s found valuable support in his fellow trainees. Even after leaving for their attachments at various Financial Institutions—Chee Leong is currently in OCBC, while his peers have been assigned to other banks and exchanges like SGX—they still meet up and exchange learnings. “I got to meet some great people through the programme, and there’s a lot I’m learning from them about their roles and the industry as a whole,” he shares.

Another challenge he faced was his family. As the sole breadwinner, Chee Leong carries a heavy responsibility. So when he first broke the news to his parents, he faced a lot of resistance; they were worried that if he failed to adjust to his new career, he would not be able to turn back.

But Chee Leong stuck to his guns and stayed committed to looking forward. “I’m more concerned with the future,” he says.

Stepping forward into a brighter future

Chee Leong has been attached to OCBC since December 2019, and within a short span of six months has already contributed to two projects. So far, he’s been involved in research and development of automation procedures, identification of gaps in existing data infrastructures, and development of a private cloud for the bank.

And he is loving his new role. “I’m actually a very technical person, so it’s the technology part that interests me,” he shares. “In my last job, my responsibilities were a lot more administrative, but with this new role, I get to work with the underlying technology that powers how things are done. So now I’m more involved in the development side of things and I get to make a real difference how the bank organises and processes its data.”

While he’s already come a long way since the start of his TFIP, Chee Leong knows there is still much to learn—and he’s excited about it. He looks forward to strengthening his expertise, and hopes to eventually use his newfound skills to develop a public or hybrid cloud system that will help banks deploy their systems better.

What others may see as a risky career move, Chee Leong saw as the smart decision that would lead him to a brighter future—not just for himself, but for his family too.

If you’re a mid-career professional like Chee Leong looking to make a switch to the financial services industry, you can reach out to IBF Careers Connect about other opportunities to upskill or reskill and join the financial services sector.

This article is part of a series of stories on PMETs who have gone through an upskilling or reskilling transformation journey wtihin the banking and finance industry.

(Information in this article are accurate as at time of publication, August 2020)

Overview

Overview